Advanced Accounting Course in Delhi, GST Return Filing Course in Delhi, 100% Job Guarantee, Free SAP HANA Finance Course Private

3月前 - Learning - Delhi - 157 viewsSLA Consultants India offers a comprehensive suite of advanced accounting and GST return filing courses in Delhi, designed to meet the needs of both fresh graduates and working professionals seeking practical, job-oriented training with a 100% job guarantee and the added benefit of a free SAP HANA Finance course.

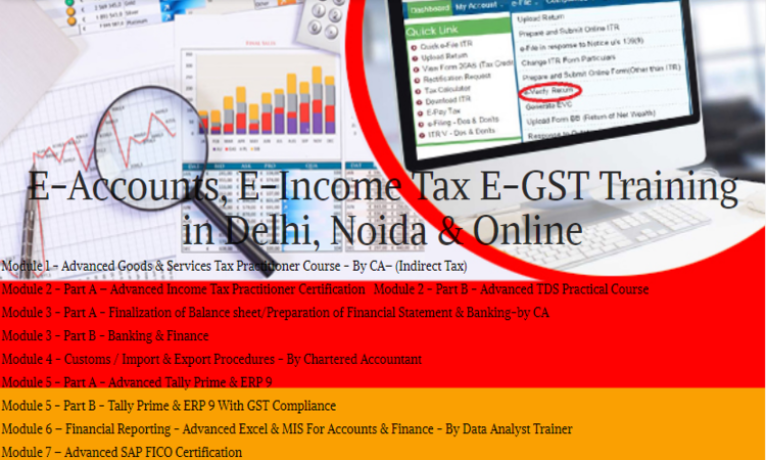

Advanced Accounting Course in Delhi

The Advanced Accounting Training Course in Delhi at SLA Consultants India is structured to provide in-depth, industry-relevant knowledge in areas such as E-Accounts, E-Taxation, and E-GST. The program is delivered by experienced Chartered Accountants and industry professionals, ensuring real-time exposure through live projects, hands-on assignments, and practical case studies. The curriculum covers:

Advanced Excel for accounting and MIS

SAP FICO and Tally ERP9 for practical accounting management

Finalization of balance sheets and preparation of financial statements

Banking and finance documentation, including project reports and ratio analysis

Payroll processing, including PF, ESI, and salary taxability

Customs, import, and export procedures

GST Return Filing Course in Delhi

The GST Return Filing module is a core component, focusing on:

GST migration and registration

Filing various GST returns (GSTR-1, GSTR-3B, etc.)

Input tax credit, refunds, and compliance

E-way bill generation and GST rules

Real-time online e-filing and compliance using Tally and SAP FICO

100% Job Guarantee

SLA Consultants India provides a 100% interview guarantee: after completing 70% of the course, their placement team arranges interviews until the candidate secures a job. This robust placement support is backed by partnerships with MNCs and leading corporates, making the institute a preferred choice for those aiming for immediate employment in the accounting and taxation sector.

Free SAP HANA Finance Course

Enrollees benefit from a free SAP HANA Finance course, which covers:

SAP HANA architecture, modeling, and implementation

SAP S/4 HANA Finance modules, including core financial accounting, cash management, and asset accounting

Real-world projects, workshops, and live training sessions

SAP Fiori applications for real-time analytics and reporting

Migration processes and best practices for SAP HANA

The SAP HANA Finance training is delivered by certified consultants with over 10 years of experience, and includes hands-on practice in real HANA systems, ensuring participants gain both conceptual and practical expertise. Upon completion, candidates receive industry-recognized certification, further enhancing their employability.

Course Delivery and Eligibility

Flexible learning: Classroom and online options with rescheduling and doubt-clearing support

Duration: Accounting/GST course (200–210 hours); SAP HANA Finance (40–50 hours)

Eligibility: Open to graduates and professionals seeking to upskill or start a career in accounting, taxation, or SAP consulting

Summary of Key Benefits

Industry-oriented curriculum covering all major accounting, taxation, and GST topics

Practical training with live projects and real-time e-filing

100% job guarantee with dedicated placement support

Free SAP HANA Finance certification for advanced skills in financial technology

Experienced faculty and flexible learning modes for maximum convenience and support

This makes SLA Consultants India a leading choice for those seeking advanced, practical accounting and GST training with assured job placement and valuable SAP HANA Finance expertise in Delhi.

SLA Consultants Advanced Accounting Course in Delhi, GST Return Filing Course in Delhi, 100% Job Guarantee, Free SAP HANA Finance Course Details with "New Year Offer 2025" with Free SAP FICO Certification are available at the link below:

https://www.slaconsultantsindia.com/accounts-taxation-training-course.aspx

https://slaconsultantsdelhi.in/training-institute-accounting-course/

Accounting, Finance ▷ CTAF Course

Module 1 – Advanced Goods & Services Tax Practitioner Course - By CA– (Indirect Tax)

Module 2 - Part A – Advanced Income Tax Practitioner Certification

Module 2 - Part B - Advanced TDS Practical Course

Module 3 - Part A - Finalization of Balance sheet/Preparation of Financial Statement & Banking-by CA

Module 3 - Part B - Banking & Finance

Module 4 - Customs / Import & Export Procedures - By Chartered Accountant

Module 5 - Part A - Advanced Tally Prime & ERP 9

Module 5 - Part B - Tally Prime & ERP 9 With GST Compliance

Module 7 – Advanced SAP FICO Certification

Contact Us:

SLA Consultants India

Above Titan Eye Shop,

Metro Pillar No.52,

Laxmi Nagar, New Delhi - 110092

Call +91- 8700575874

E-Mail: hr@slaconsultantsindia.com

Website: https://www.slaconsultantsindia.com/